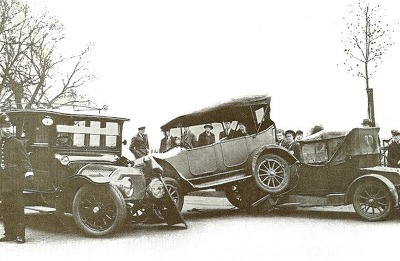

Precautions and guidelines for subscribing to driver insurance and accident insurance!!!

Precautions and Guidelines for Subscribing to Driver's Insurance Accidental Insurance

accident insurance Silver Products for which insurance money is paid according to the combined disability payment rate for deaths, disabilities, surgeries, hospitalizations, fractures, etc. due to various accidental accidents and leisure activities, including traffic accidents. It is an insurance policy that covers traffic injuries, general injuries, leisure injuries, and travel injuries.

Driver insurance vs. accident insurance difference

Driver insurance guarantees criminal and administrative responsibility in case of accidents and accidents while driving, and accident insurance guarantees various accidents and accidents for the person.

Why driver insurance is required

Car insurance alone is not enough!

Many drivers recognize auto insurance as an essential insurance, and many respond stingy to driver insurance.

Even

There is a driver who equates car insurance with driver insurance, and if car insurance is for others, driver insurance is a product that can protect itself from car accidents and general injuries.

*How to subscribe to driver's insurance

1.

Subscribe to the security of the traffic accident support fund.

.

If a victim dies in a driving accident, you can receive a guarantee of 30 million won, 10 million won for more than 6 weeks, and 20 million won for more than 10 weeks and less than 20 weeks.(Except for drinking, unlicensed, and escape)

2.

The cost of defending fines is also selected with high guarantees.

In the event of a car accident, an agreement with the victim does not eliminate criminal responsibility, so the defense cost of fines and lawyers is used as collateral.

3. High collateral for automobile insurance premium surcharge, traffic accident handling costs, and license cancellation/ suspension compensation.

4. Choose one with a wide coverage period of up to 20 years, 80 years, and 100 years old.

5. In addition to driver collateral, special agreements for inpatient medical expenses, outpatient medical expenses, liability for compensation in daily life, fracture/burn diagnosis expenses/surgery expenses are used.

It is recommended to sign up to ensure comprehensive coverage of accidents that may occur during daily life.

*How to subscribe to accident insurance

1. In the event of an accident, it is better to check the coverage and sign up.

When choosing accident insurance, it is not a good insurance policy just because it comprehensively covers all transportation and accidents that can occur in everyday life and has high coverage only for specific accidents.

2. In the event of an injury or death, the guarantee amount and the disaster injury diagnosis amount are checked.

If you are judged as a disability grade due to a disaster or traffic accident, you have no choice but to live with the help of your surroundings, so you have to find out whether the amount is guaranteed to live in a state of disability, and in case of death, you sign up in consideration of the amount of the bereaved family's guarantee.

3. Accident insurance subscribers must notify them of their job change.

According to the accident insurance policy, if a cause of risk, such as a change in the job or job at the time of insurance subscription, occurs after insurance subscription, the insured is required to notify the insurance company in writing.

If an accident related to a changed job or job occurs without notifying the insurance company, it is recommended to notify the company when changing jobs because it is required to pay reductions according to the premium ratio before and after the job change.

4. There is a difference in insurance premiums depending on occupation and men and women.

Since the male mortality rate is higher than the female mortality rate, there may be a difference in insurance premiums depending on the risk rate, and there may be a difference in insurance premiums and coverage amounts because the risk rate varies depending on the occupation.

5. Choose an insurance company that pays quickly and handles insurance well.

It is better to prepare in advance for various accidents and driving accidents that can occur in our daily lives at any time in our lives.

Driver/injury insurance company officials advise that it is economical for customers to receive price comparison guidance through driver insurance accident insurance recommendation products and insurance comparison sites through insurance experts.

*Recommended link: Free driver/injury insurance consultation application